Who’s afraid of a recession?

It’s not much more than sense, but it does feel like sentiment towards small-caps is improving. This is the first time we could have made even this equivocal statement for more than a year.

In the US, the Russell 2000 Index (representing the smallest US companies) is up 13% over the last eight weeks. Locally, our comparable index has been range trading for nine months, but we are starting to see instances of positive news lifting share prices, which is something that has been absent.

In a further sign of the green shoots, brokers are starting to talk about IPOs again. On average there have been 140 IPOs per annum on the ASX, there have been just 17 so far in 2023, but 10 more have been announced. M&A Activity is increasing – in resources the value of deals this year is more than in 2021 and 2022 combined.

“The only function of economic forecasting is to make astrology look respectable.”

– John Galbraith economist

Howard Marks, the co-founder of Oaktree Capital Management, recently wrote a letter to investors about the futility of macro forecasting, concluding that due to the vast array of corollary inputs, it was impossible. He argued that the exercise of macro modelling is not pointless, but its infallibility is illusory, and we need to stop assuming it has predictive value for the stock market.

With macroeconomics news still dominating the conversation, the key concern we hear from our investors is: what happens to the Fund if there is a recession?

The stock market is largely unaffected by the GDP contraction, or at least, typically it is priced-in well before it happens.

Let’s look at the data. Remarkedly Australia has only experienced seven quarters of negative GDP growth since 1995 (28 years).

But, if we are to suffer another one, what can we expect the impact on the stock market to be, if we use history as a guide?

As the chart below shows, in most previous instances, it was uncorrelated. On average the market was up +5% in the 6 months after a contraction, and +13% in the following 12 months.

How can this be, surely companies’ earnings are deteriorating and the valuation multiple applied to future earnings trimmed, to reflect the worsening economic outlook?

Yes, and yes; but the stock market is the aggregate view of all participants. When contractions occur, they have largely already factored into stock prices, because those participants have anticipated this outcome based on the news they have been hearing for months.

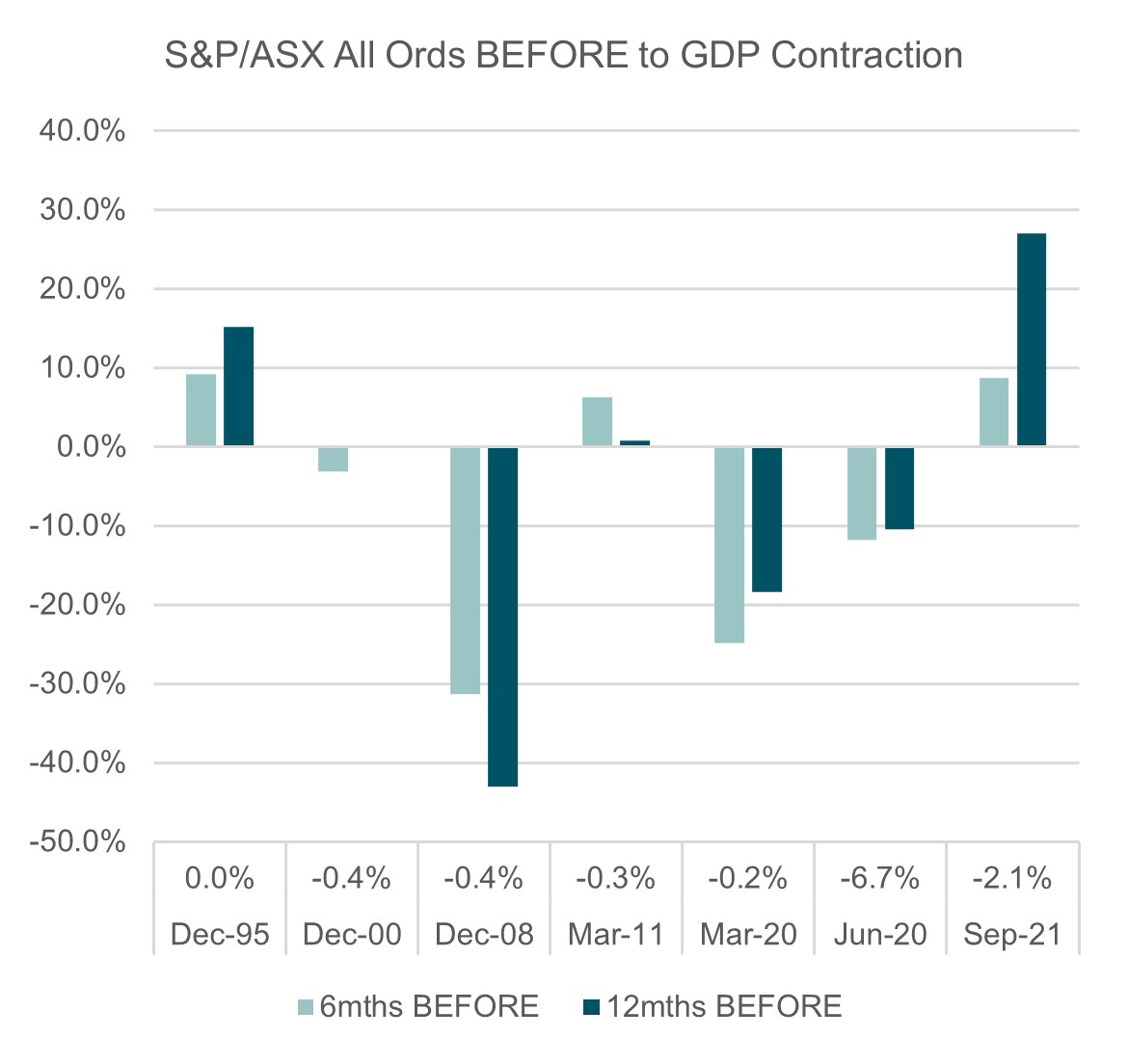

This is illustrated by looking at the stock market performance in the period before the period of negative growth. As we can see in the chart below, on average, the market fell by 7% in the 6 months prior to economic contraction and by 4% in the 12 months prior.

This is not to say the underlying companies in the Fund will not be impacted by economic downturn but, if a contraction should occur, based on history, it is unlikely to impact share prices.

Over the last three years, smaller companies have suffered from Covid induced labour issues, supply chains freezing up, lockdowns, rampant inflation, a deterioration in trading terms with suppliers, soaring energy input costs, an unprecedented cadence of interest rate rises and a collapse in equity market support.

These factors are either historical, or dissipating, and in our view, an economic slowdown will still be, by comparison, an improvement on the environment they have navigated over the last three years.